Share

Author

Sam Bayer

Share

Did I just write that?

SAP accused of monopolistic behavior? SAP HANA’s future might be in jeopardy? Say what?

Yup.

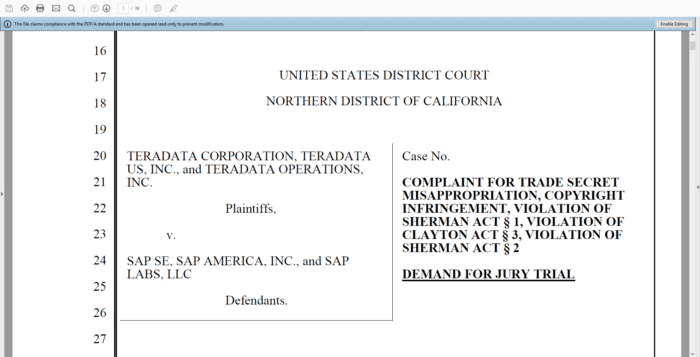

One week ago today Teradata, a US based >$2B software provider of database and analytics related products and services, filed a 5 count complaint against SAP alleging Teradata Intellectual Property theft and SAP monopolistic behavior that has caused them harm and, according to the suit, they “will continue to suffer irreparable harm as a consequence of SAP’s conduct.”

Teradata accuses SAP of stealing the IP that went into developing the HANA database and then monopolistically excluded Teradata from competing for the evolving HANA driven Business Warehouse and Analytics business. To that end, Teradata is seeking some serious financial relief and to alter SAP’s behavior in the marketplace.

This isn’t the first time that someone has sued SAP and it certainly won’t be the last. It may take months or years, but more than likely this suit will be settled out of court for some undisclosed (huge) sum of money and without SAP ever admitting any wrongdoing.

So why am I, and if you’re reading this, why should you, be interested in this lawsuit?

Two reasons.

- First of all, it makes for a fascinating read.

Click on the image to get your very own 36 page copy of the filing. Take it to the beach with you.

As the filing conveys, IP theft and monopolistic behavior make for a potentially lethal business cocktail. Swirl in doses of deception, defections and whistle blowing investigations and sprinkle in periods of partnership bliss followed by irreconcilable difference fueled divorce and you’ve got quite the plot. Although the writing is a bit dry, the characters and story-line are riveting. No doubt this is only the first chapter of many more to come.

Read it. You’ll love it.

- It defines a “Top-Tier ERP Applications Market” and establishes SAP’s market power within it.

Way back when, in August of 2017, in my blog post entitled “SAP Indirect Access: Duke Law Professor Says Fees are Illegal” I introduced the fact that SAP was clearly violating anti-trust laws with their enforcement of Indirect Access licensing in the field. Professor Richman’s words were:

“In short, SAP’s conduct limits consumer choice, gives SAP an anticompetitive advantage in the ERP-accesory market, and undermines a currently competitive and dynamic marketplace for ERP accessories.”

Since then, I’ve had many, many…way too many…conversations with lawyers all over the world. While everyone seems to agree that SAP’s Indirect Access behavior clearly violates anti-trust laws both here in the US and in the EU, there was hesitancy in moving a case forward for one simple reason; you have to prove that SAP holds a market dominant position in the ERP market. Without that, you can’t claim anti-trust violations and that would be SAP’s first defense. SAP’s marketing braggadocio not withstanding, proving market dominance wasn’t going to be easy in a court of law and constitutes the single biggest risk with moving a lawsuit forward.

Enter Teradata v SAP.

Teradata’s lawyers, Morrison and Foerster , put forth the following arguments (pages 18-20 of the suit above) establishing SAP’s market dominance in the Tier 1 ERP market:

- Tier 1 ERP application customers “generally consists of the largest companies in the world, such as Fortune 1000 companies in the US and FTSE 100 companies in Europe, and similarly-sized-privately held entities”.

- “These customers possess some or all of the following characteristics: (1) millions of transactions and/or data-generating events on a daily basis; (2) multiple and distinct business lines; (3) diverse geographic locations for operations; (4) multiple and disparate sources and formats of data related to distributors, suppliers, competitors, customers, and/or employees; and (5) revenues typically exceeding $1 billion. These characteristics result in customer demand for highly customizable and flexible software that is readily scalable.”

- When Tier 1 ERP vendors “announce the end, or “sunset,” of prior versions of its ERP Applications, Top-Tier ERP Applications customers have no choice but to upgrade.

- “There are no reasonable or adequate economic substitutes for upgrades of SAP”.

- An information disparity exists between Top Tier ERP vendors and their customers because customers “are unable to perform a detailed cost analyses for the lifecycle of their ERP applications at the time of purchase”.

- “Severe switching costs associated with changing a customers’ Top-Tier ERP Applications provider effectively preclude the vast majority of customers from changing their ERP applications.”

And finally, the MOFO lawyers (don’t laugh) put the icing on the monopoly cake:

“SAP has held and continues to hold a dominant position in the Top-Tier ERP Applications Market, and possesses a market share that ranges, on information and belief, from 60% to 90% depending on the industry in which the customer operates. Oracle is the only other significant competitor for these Top-Tier customers, but industry research indicates that Oracle’s market share has historically been less than SAP’s with respect to the number of installed Top-Tier ERP Applications customers.”

So there you have it SAP Indirect Access watchers out there. Keep your eyes on the Teradata lawsuit. If the courts buy into their definition of “SAP’s market power and position in the Tier 1 ERP market”, than I predict things are going to change in SAP’s Indirect Access licensing construct. The key provision that stipulates that Indirect Access is free for SAP products (hybris, Successfactors, Ariba, etc.) but must be licensed if you use third party or homegrown applications (Salesforce, Microsoft, Coupa and Corevist) will certainly have to be amended.

As Professor Richman pointed out last year, “SAP’s licensing contracts and intellectual property rights do not sanitize anticompetitive conduct”.

That’s it for today. I’ve gotta run. More meetings with lawyers. :-(

Onward!

[want_more title=”Learn more” subtitle=”FREE Case study: 150% Sales Growth with Rich Content” description=”Learn how a leading flooring manufacturer more than doubled sales with a B2C-style catalog.” button_text=”Download Now” button_link=”/” button_class=”btn btn-primary mannington-ae” title2=”See it for yourself” subtitle2=”Talk to us” description2=”Curious what Corevist Commerce can do for you? Let us show you a personalized demo. You’ll see ecommerce with real-time SAP data.” button_text2=”Schedule Demo” button_link2=”https://www.corevist.com/demo/” button_class2=”demo-popup”]